The only source of DeFi prices: our Token API. Simple. Powerful. Try it.

DeFi Transformations

Build. Access.

We curate blockchain data for developers. We keep it simple. We give you power.

- Raw data for explorers.

- Simple APIs for developers.

- A transformation platform for quants.

- Raw data

- 40 TB

- Number of models

- 400

- API calls

- 4 billion

Available On

Ethereum

Polygon

BNB

Avalanche

Arbitrum

Optimism

Fantom

Easy-to-use APIs

Access historical and real-time data instantly. Free.

Token API

Access granular token data.

- Current and historical token prices

- DEX liquidity

- Holdings

- Token metadata

Learn more

Portfolio API

Trace portfolio activity.

- Token price and balance

- Wallet activity

- Risk metrics

Learn more

DeFi API

Run any transformation with one endpoint.

- Access 400+ existing transformations

- Build your own transformations and access

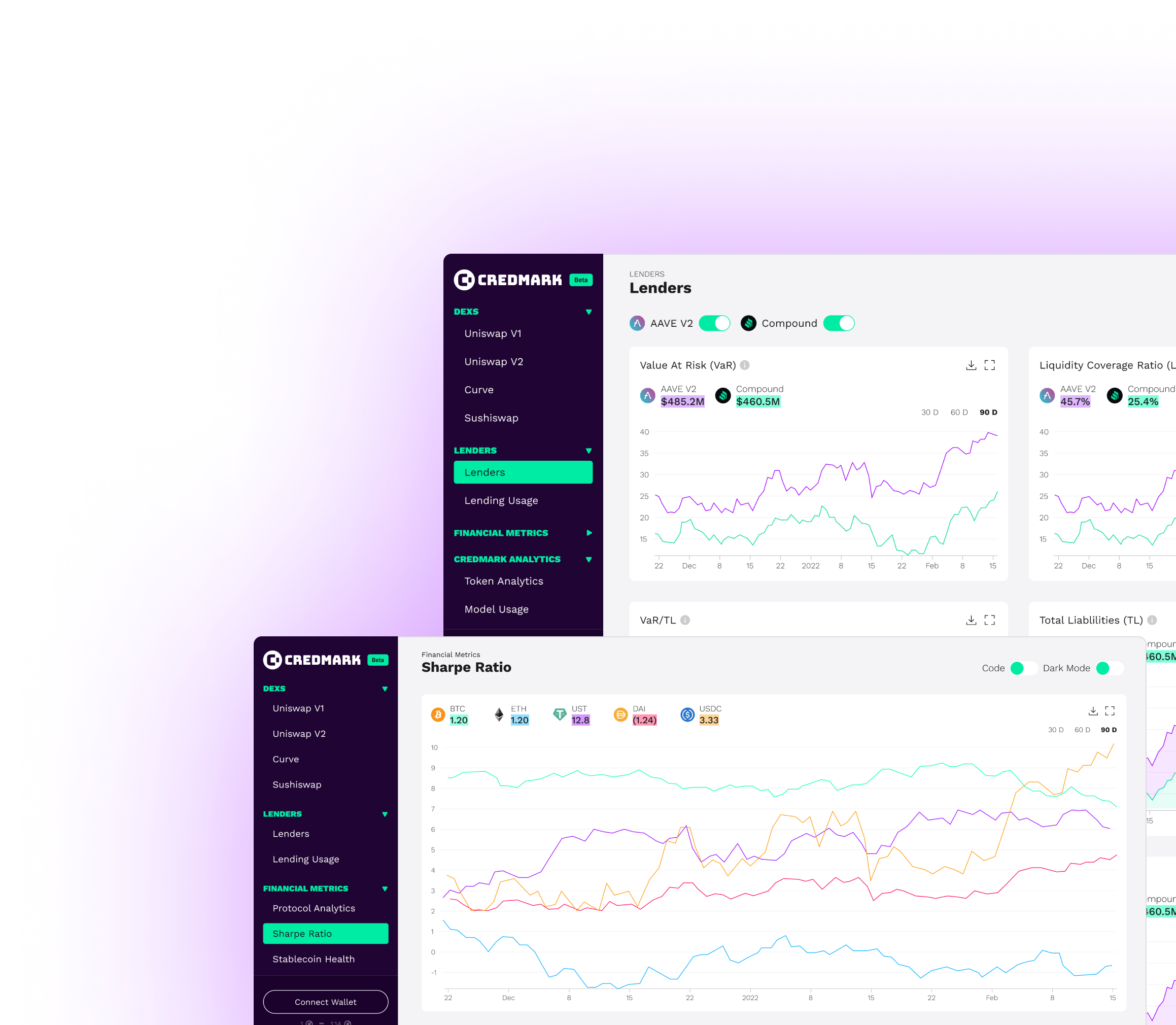

- Check out the Credmark Terminal, powered by our DeFi API

Learn more

Raw data

Fetch the latest block or access historical blockchain data to monitor or trace any activity from the genesis block. Our data is accessible via the Snowflake Marketplace. We currently support:

- Ethereum

- Polygon

- BSC

Learn more

Build your own transformations

Use our RPC nodes, or your own. Use our decoded, indexed historical data. Use existing transformations. Use the most powerful transformation platform in DeFi to access and transform data.

Powerful Data

Curated for fast, easy access.

Highly composable

Leverage existing transformations.

Python

Write your models in Python. We’ve integrated all the data science libraries you need. And we support Jupyter Notebook.

See our DeFi API in Action

Discover the potential of our DeFi API in our Terminal. Visualize some of our models and gain insight into popular DEXes and protocols like Uniswap, FRAX, Curve, Aave and more!

What our customers say

Sign up for our newsletter for the latest product updates, partnerships, and more.