Credmark Platform and Tokenomics

Part II

Momin Ahmad

2021/12/15

The post will explore how our token, $CMK, will function within the platform. However, we will start by explaining the following: Why Credmark is valuable to Defi.

We will follow that by explaining:

- Functions users will be able to use after MVP launch.

- How $CMK works within the ecosystem.

- How partnerships affect tokenomics

Why is Credmark crucial in the current state of DeFi?

The rapid rise of DAOs and new protocols will inevitably drive demand for scalable, non-custodial services, such as: liquidity as a service for deep liquidity, insurance, multisig management, treasury management, payroll, and on-chain data.

As DAOs and protocols become more sophisticated, they will also need high integrity risk assessment services. Proper risk management requires access to high integrity data as well as expert analyses. As a DAO that collects blockchain data ETL and conducts risk research, Credmark is well-positioned to address this demand.

Current Landscape of Risk Assessment

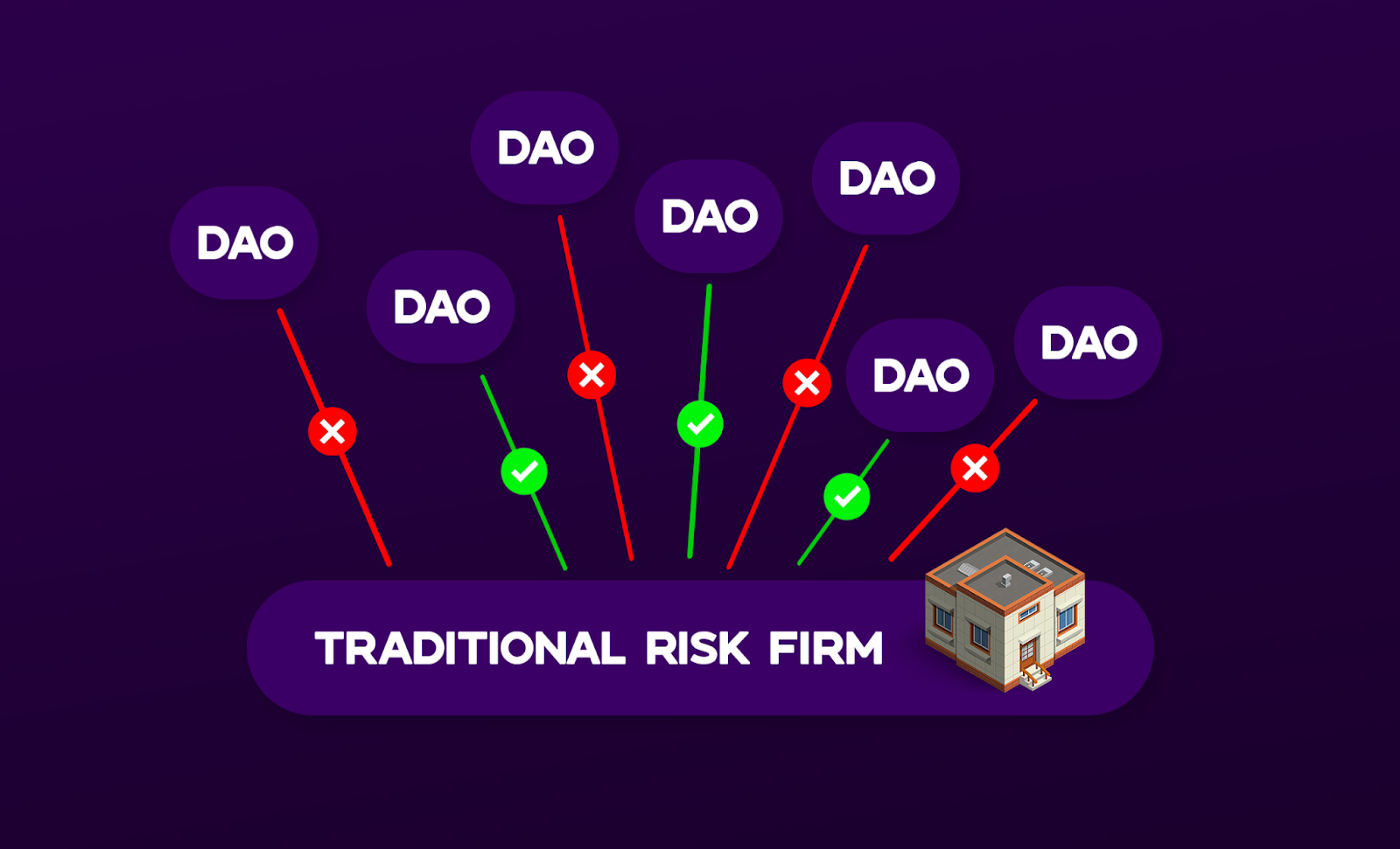

Conventionally, organizations either develop risk management strategies in-house or they delegate this to an external risk service provider.

The in-house option requires hiring, training, and maintaining an in-house risk team, which many organizations are not equipped to do. As a result, such organizations opt for external risk firms.

However, putting data in the hands of an external service provider is fundamentally incompatible with the non-custodial nature of DAOs.

In addition, relying on traditional risk firms is simply not sustainable, since these firms cannot keep up with:

- surging demand from an increasingly large number of DAOs

- rapidly evolving protocols, business models and forms of governance

This is why we at Credmark believe that a DAO-to-DAO model is the answer.

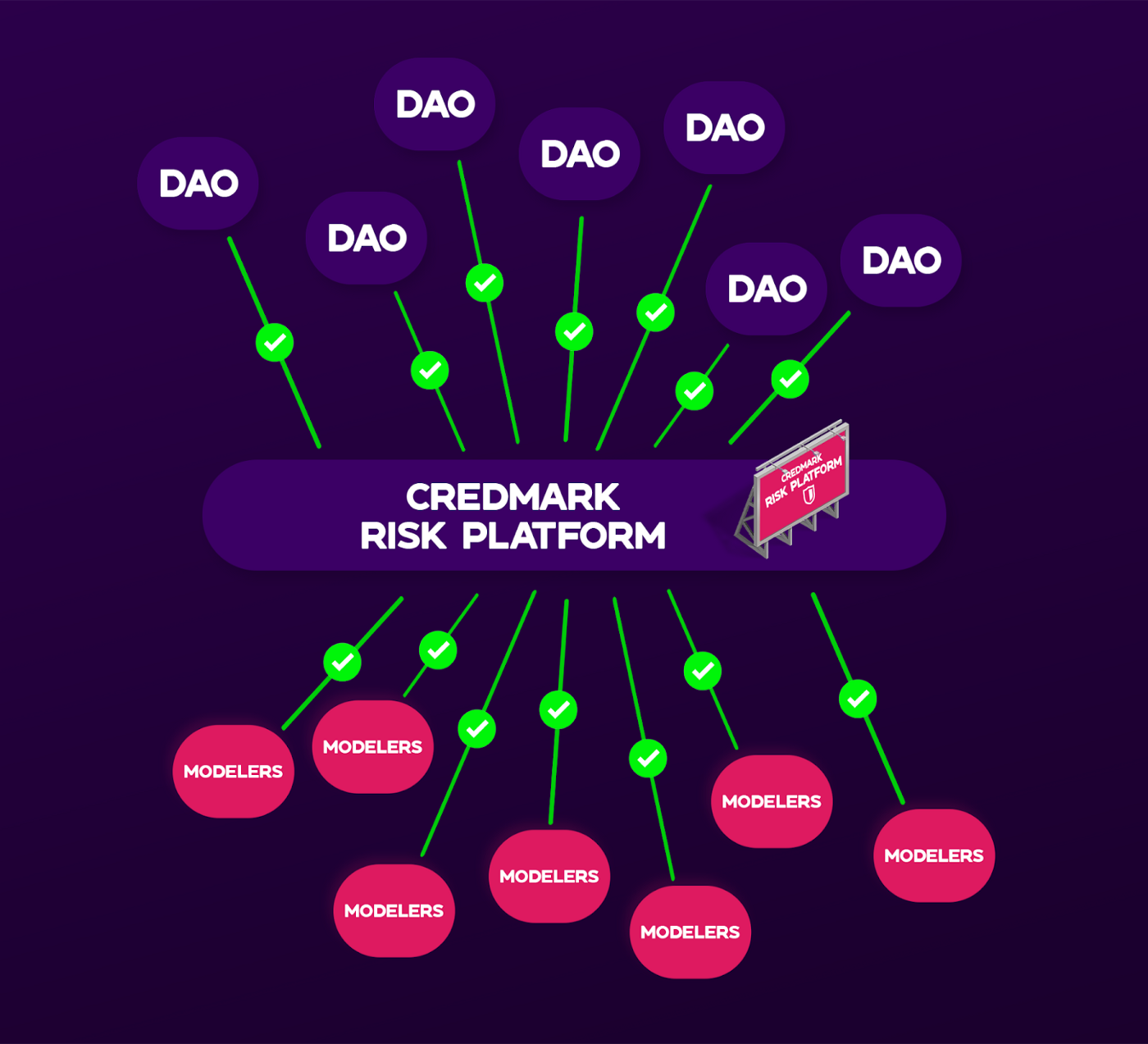

How Credmark can help?

A DAO-to-DAO model allows different communities to partner up in a non-custodial and permission-less way.

Credmark believes providing DAOs with the right tools and frameworks is key to preserving their decentralized nature. Organizations and individuals can also enjoy an unprecedented level of interoperability without needlessly worrying about time and resources invested like what often happens in centralized environments.

Building towards decentralization requires leveraging the expertise of the platform. Naturally, as the infrastructure is gradually built out, developing new tools and framework to adapt to changing climates is crucial.

For example, when a DAO requires risk assessment into a specific pool of assets, our platform would be able to consolidate the data and bring together relevant modelers to help define the risk parameters. However, risk can also adjust over time. Building the foundational infrastructure for the community to utilize is of the utmost importance.

Such is the nature of an ecosystem — providing a scalable one stop solution.

So that’s where we want to end up. But where are we now?

The Credmark Platform will go live on Dec 15th.

There are 2 parts to our launch.

First, you can stake your $CMK. This allows you to access the Credmark Terminal, and to get rewards and future revenue from the Credmark Platform.

The Credmark DAO will be using our Community Treasury to distribute linear staking rewards. Our goal is to distribute 1MM $CMK in rewards over the next year.

This will start at a very high interest rate that will decline as more people stake their $CMK. Staking rewards are issued upon a user staking or un-staking, so that the value of xCMK is always higher than $CMK, and grows at a minimum frequency of every 8 hours.

Once you have xCMK, you’ll be granted access to the Credmark Terminal. This will show our risk metrics that we develop. We’re starting with live and historical Value at Risk (VaR) and Liquidity Coverage Ratio (LCR) for Aave and Compound, and will be adding more factors and protocols every month.

As the platform matures, the data viewed on the Credmark Terminal will be come available via API. This API will be the core product offered by the Credmark Platform. Our Partners will acquire and stake $CMK in order to access the API, Modelers will acquire and stake $CMK in order to build and submit models and Validators will acquire and stake $CMK in order to guide the development of models.

But on December 15th, we want $CMK holders to stake on our platform to help stabilize the ecosystem while also earning rewards.

Crucible Reward Program

With $CMK ‘s upcoming staking features, many are wondering what’s going on with our Alchemist Crucible Rewards program.

The purpose of $CMK native staking is for stabilizing the platform whereas the crucible program is focused on providing liquidity. Every time we add rewards, it is set to expire in 5 months. The last time it was set was 2 weeks ago so there will be another 4 and a half months left of rewards.

If there is a demand for more liquidity, then consequently more rewards will be added. With native staking of $CMK, the APY will be very high and drop as more participants join in.

Sign up for our newsletter for the latest product updates, partnerships, and more.