Going Right up to the Edge of the Liquidity Crisis

Neil Zumwalde

2021/03/10

Note: This piece uses Aave as an example, but these dynamics apply to DeFi widely.

DeFi is a no-brainer.

Suddenly the same mechanisms that institutions use to make money are available to anyone with a computer and a small stack of cryptocurrencies. The individual is now the institution, and collapsing capacity to the individual is historically a sign of a good technology.

But with great rewards, come great risks, and most individuals don’t have a personal risk management team to manage them.

The wheel quickly turns on different DeFi protocols, and right now Aave’s aUSDC pool is having a risky moment. They have a brilliant team that thinks about this: Read how Aave mitigates risk.

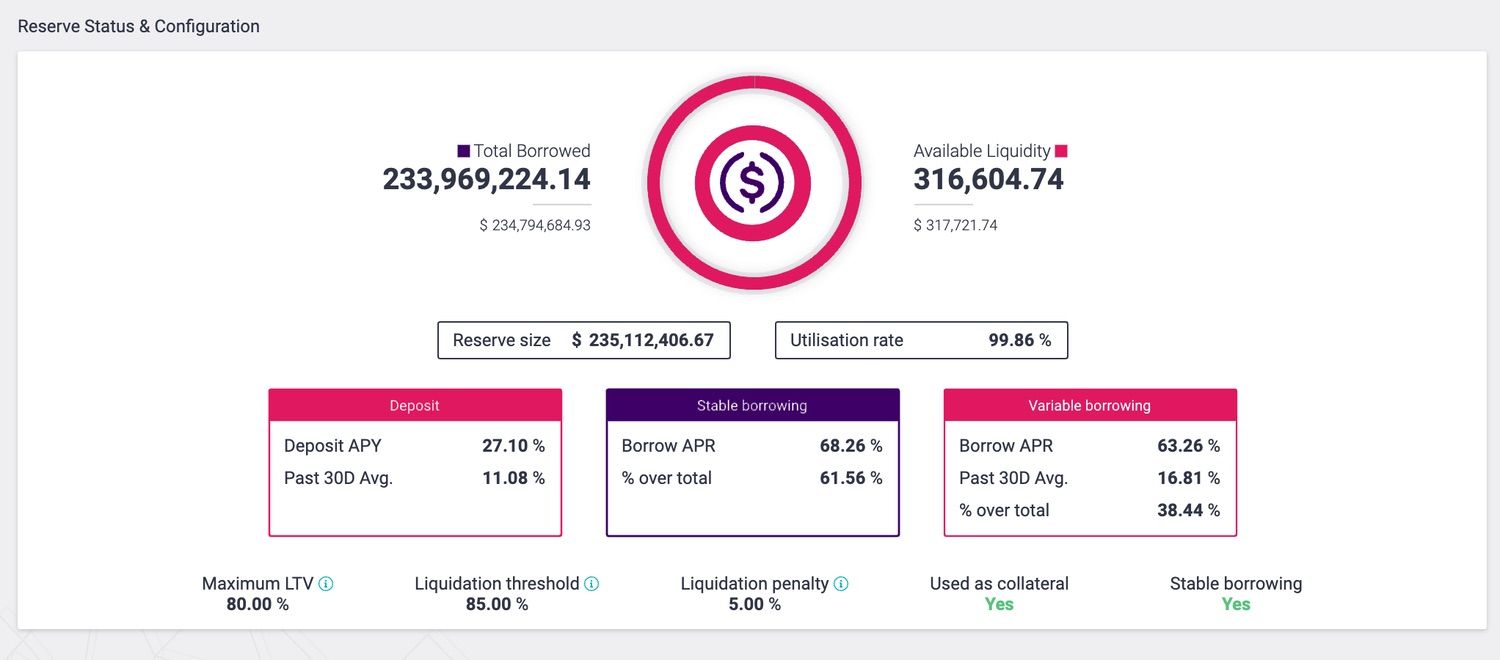

https://app.aave.com/reserve-overview/USDC?pool=AaveV2

See that red circle? That’s the amount of the reserve pool that’s been borrowed. A whopping 99.86%. The borrow interest rate is currently sitting at 68% (63% for stable) meaning that if users did nothing at all, it would take a little less than a day for the amount of USDC debt to be higher than the amount of total supplied USDC.

Aave, Compound, and the rest of DeFi have survived some serious volatility in the past, but it’s always worth reexamining the protocol stability as conditions change.

What are the worst case DeFi scenarios? Here’s a few that we’re looking into:

- 1 - USERS CAN’T WITHDRAW THEIR FUNDS.

When I deposit USDC into Aave or Compound, I am issued aUSDC or cUSDC. This is a token that means that the protocol owes me the deposited USDC plus interest. The USDC reserves are used to fund that withdrawal. If the funds don’t exist in the reserves, There’s no USDC to withdraw.

Right now there are 4700 Borrowers and Depositors in the aUSDC pool. There are plenty of positions that account for greater than the current available liquidity. These users can’t currently withdraw the entirety of their funds.

If they need to in order to pay back a borrowed position from another protocol, they can’t get access to the funds, and consequently the other protocol can’t free up that borrowed amount, the problem compounds.

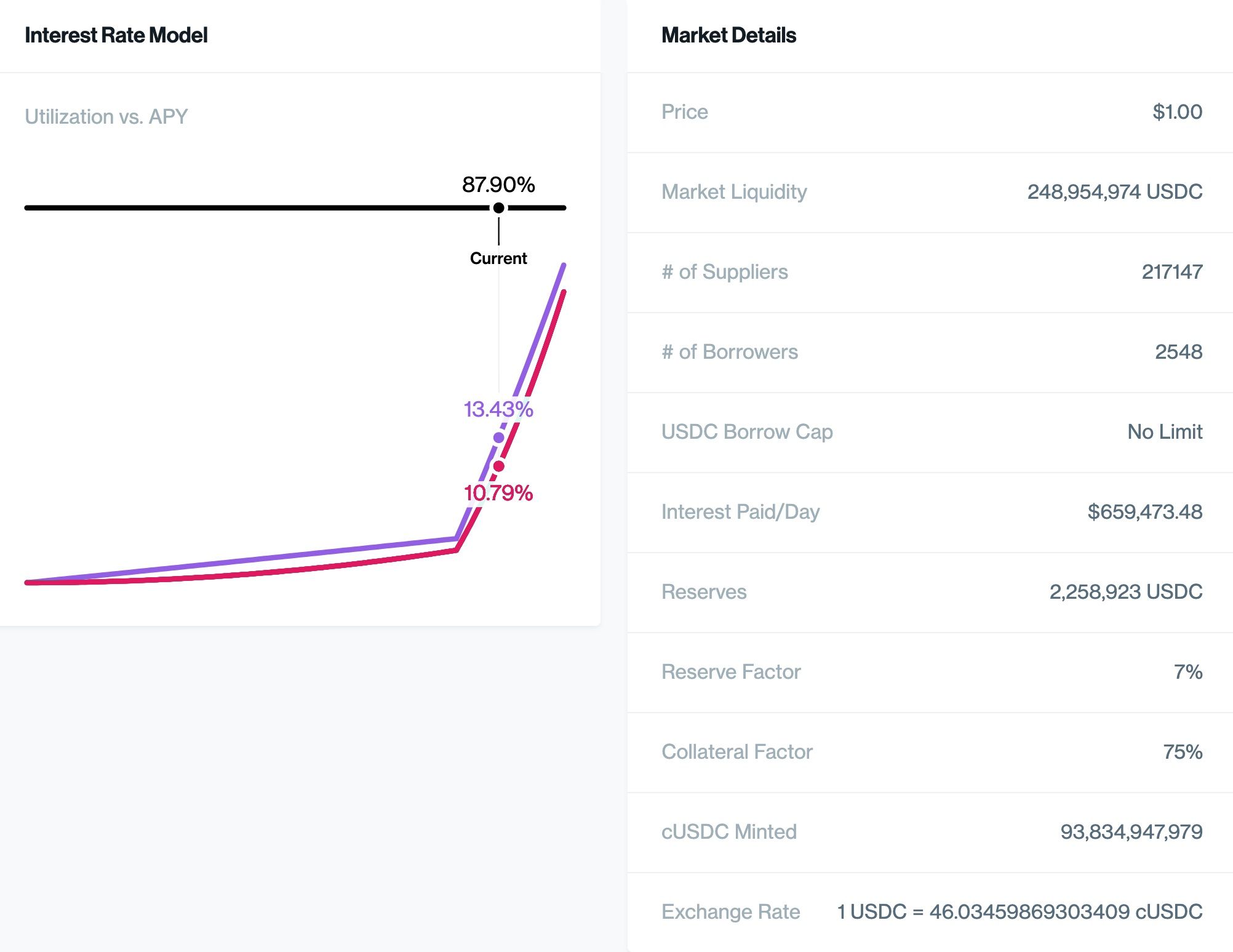

Compound cUSDC pool at ~88%

- 2 - LIQUIDATION REWARDS AND COLLATERAL BECOME UNAVAILABLE

When a loan becomes insufficiently-collateralized (85% LTV for aUSDC), it can be liquidated by any user. The liquidator pays back the loan, and collects that value of the loan plus the liquidation penalty. This penalty ranges from 5% — 8% of the value of the loan. If that value isn’t in the collateral’s reserve, The liquidator can’t collect, and the loan can’t be liquidated.

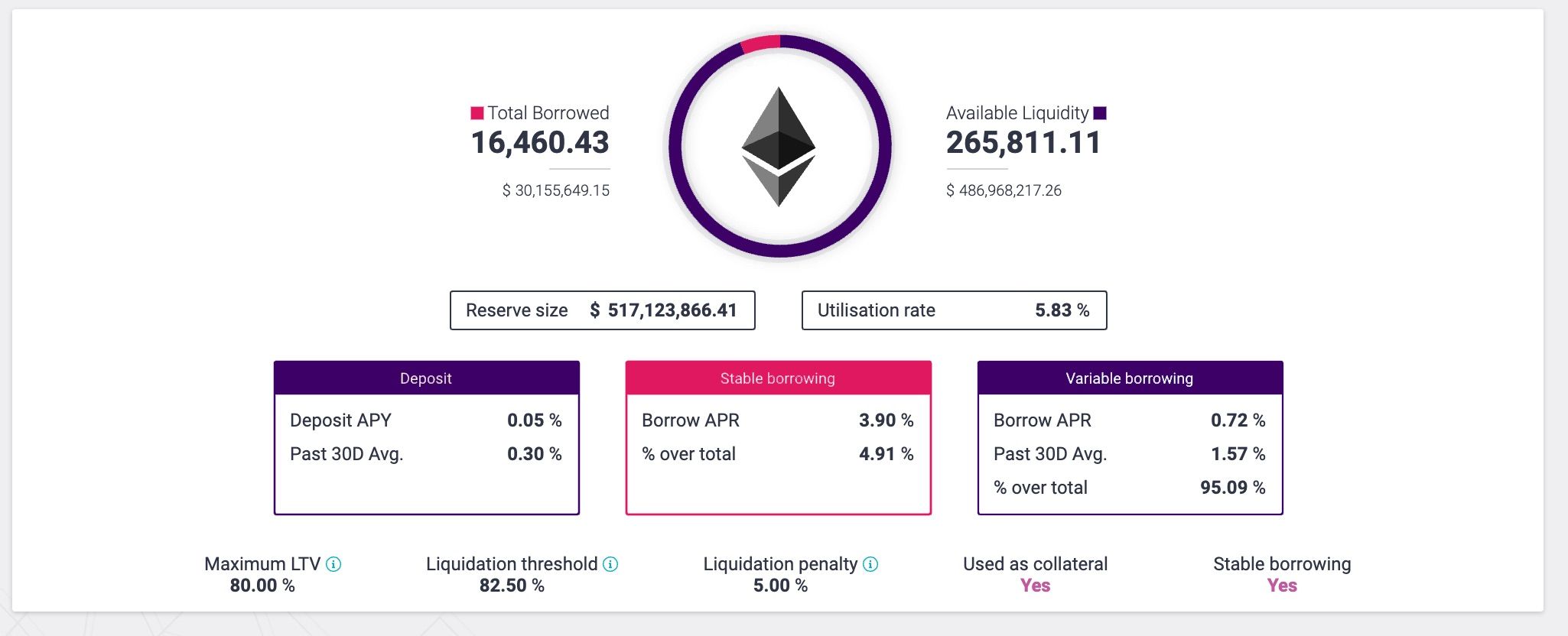

This scenario is unlikely in the short term since most people use a volatile asset as collateral (Such as ETH) and borrow a stable one (Such as USDC). In the case of liquidating a USDC Loan, the Protocol would use the collateral reserves to pay out the liquidation penalty. This would still work, because currently ETH pools have very low utilization rates, reflecting the bullishness in the industry. Borrowing ETH with USDC collateral is similar a short, and few people are bearish enough on ETH to short it.

- 3 -LIQUIDATIONS BECOME UNPROFITABLE

DeFi protocols rely on economic incentive as enforcement. If the economic incentive goes away, so does the enforcement.

When ETH goes down in value, the LTV of a debt position goes up. Falling prices exacerbate the high borrowing interest rate and gas fees.

If the gas prices to liquidate that position are higher than the liquidation penalty, the liquidator loses money. Since most DeFi platforms only allow you to liquidate 50% of a position at a time, the liquidation penalty rewards are at max 2.5% of the value of the debt. In the case of $100 gas fees, that means that only debt positions higher than $4000 are profitable to even liquidate, and the under-collateralized loans under that amount generate interest, locking value in the protocol until they become profitable again, and further exacerbating the debt to liquidity ratio.

- 4 -BAD ACTORS TAKE ADVANTAGE OF FUD

Exploits are creative and unpredictable, but often take advantage of market sentiment. In high utilization times, these problems can be artificially exacerbated.

In the case of a high profile user being unable to withdraw or borrow funds, it’s likely that the price of the DeFi tokens would suffer. Since shorts can be profitable for market manipulators, it’s not unfeasible that someone could use these dynamics to push a protocol to the brink in order to enrich themselves by shorting it. This could create a crisis of confidence due to limited liquidity.

BE BRAVE, BE SMART

DeFi investing has always had these risks, and has endured the incredible volatility that Crypto provides, but risk is just one of the many features that make DeFi as dynamic as it is today. Be smart with your investments, don’t put in more than you’d be able to absorb if things go south, and have fun becoming the future of finance.

Sign up for our newsletter for the latest product updates, partnerships, and more.