Introducing the Credmark Terminal

A DeFi Source of Truth

Wen-Chiao Su

2022/06/21

Resources to check-out:

- Manage risk in DeFi with the Credmark Terminal

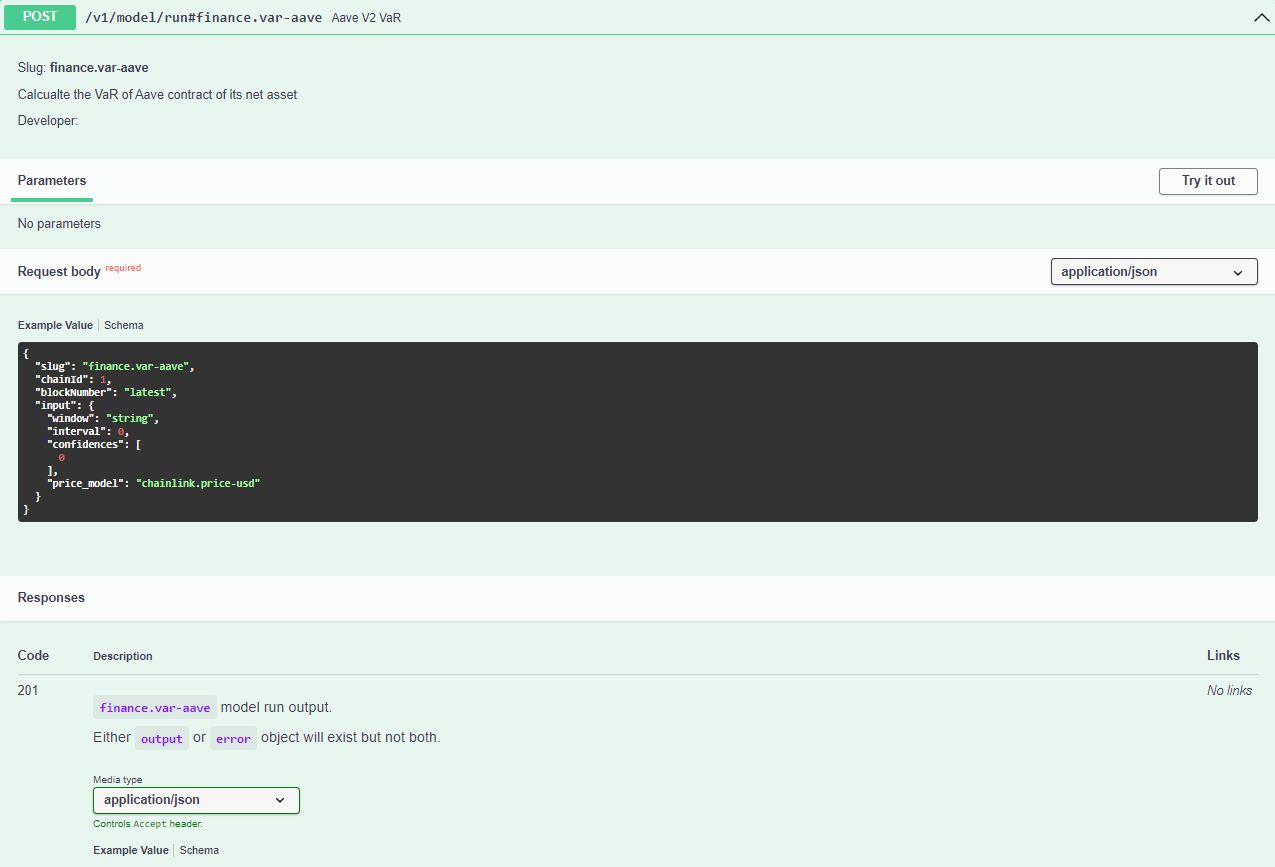

- Access the models which power the Credmark Terminal

- Build financial models with the Credmark Model Framework

Most Crypto Info is Unreliable

Information in DeFi and the wider crypto industry is widely accessible but scattered and often incoherent. It’s certainly not an understatement to say we’re dealing with information overload. To further complicate the situation, KOLs with crypto-cult-like behaviors endorse a project or shill tokens, and then casually throw in a DYOR (do your own research). It's suffocating and difficult to ascertain what’s true. Needless to say, access to reliable data and insights requires intensive research, careful analysis, and the ability to synthesize many sources of information. Instead of placing faith in individuals, well-informed decisions should be provable, backed with reliable on-chain data, and rooted in quantitative sciences. There’s a market for DeFi insights backed by clean data and validated models. The Credmark Terminal offers just that.

Introducing the Credmark Terminal

It all started with the Risk Terminal which was launched last December as an MVP. We released a dashboard that was built on a few basic models we’d developed. Visualizing these models’ output was powerful. In the meantime, our community built more and more models. So we took a step back and wondered if we could coherently organize them. This effort led to the release of what we now call the Credmark Terminal. Behind the scenes, we do all the number crunching so users can see the outputs of validated financial models like Value at Risk (VaR) and Liquidity Coverage Ratio (LCR). (Learn more about why we started with these models over here.) In a sense, the Credmark Terminal is a showcase for our models. All of the code is open source so anyone in the community can grab it to build their custom dashboards. Over time, we hope the Terminal becomes a primary source of risk data and financial data in DeFi for people who don’t require access to the raw data available via our API.

The first models we’re deploying in the Terminal cover lending protocols like Aave and Compound. Their source code can be viewed over here. All financial models are validated and verifiable, so users can verify how the models are built. Rest assured, all data is sourced from Credmark’s reliable on-chain state and ledger data.

Although risk continues to be our focus, our community has asked for other types of financial models. We’ve begun supporting those and, by necessity, had to rename the product. That’s how The Risk Terminal became the Credmark Terminal.

Most importantly, the terminal is FREE TO USE.

New Features & New Look

We’ve implemented lots of feedback from our users, added a ton of exciting features, and redesigned the entire terminal. This new interface enables us to easily scale and include more exciting features as our model repository grows. Selected models will be displayed on the terminal.

We start with 4 major categories:

- Financial Metrics

- Lenders

- DEXs

- Credmark Analytics

Financial Metrics will showcase established TradFi metrics like Sharpe Ratio but tweaked for DeFi. Other protocol metrics like VaR, TVL, and Trading Volume will be added subsequently in the coming weeks.

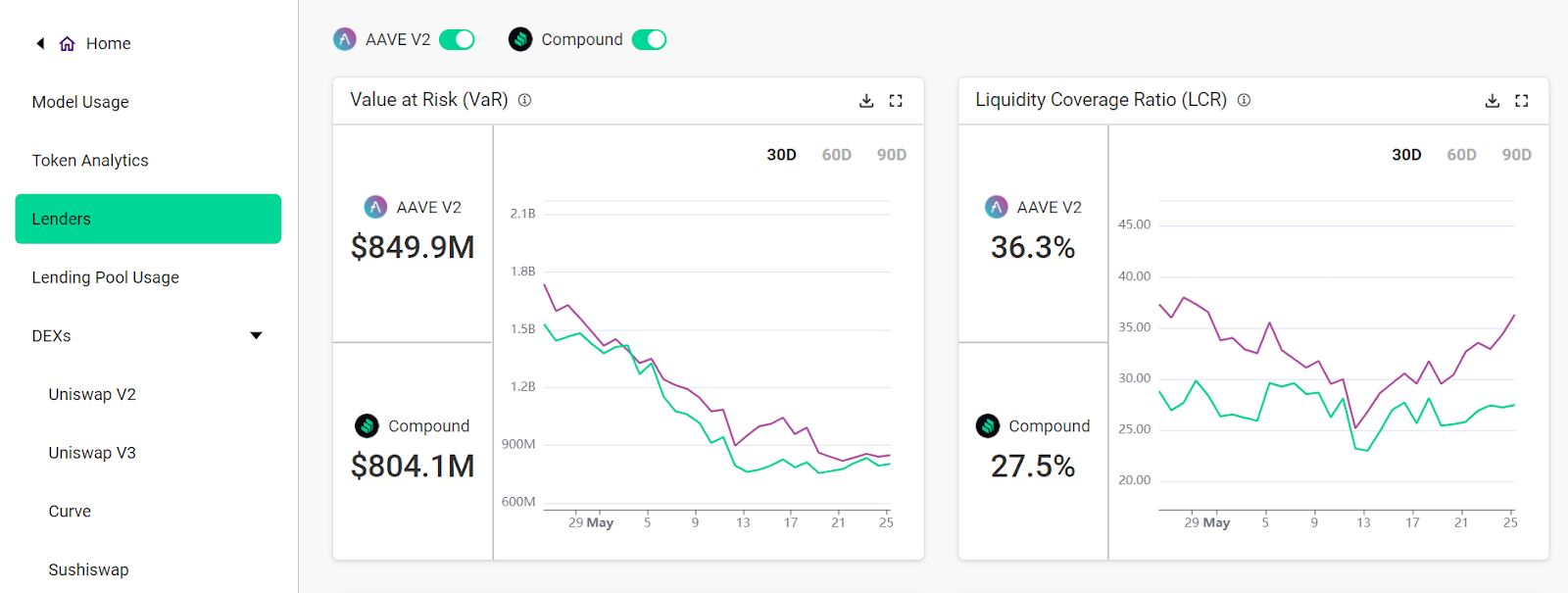

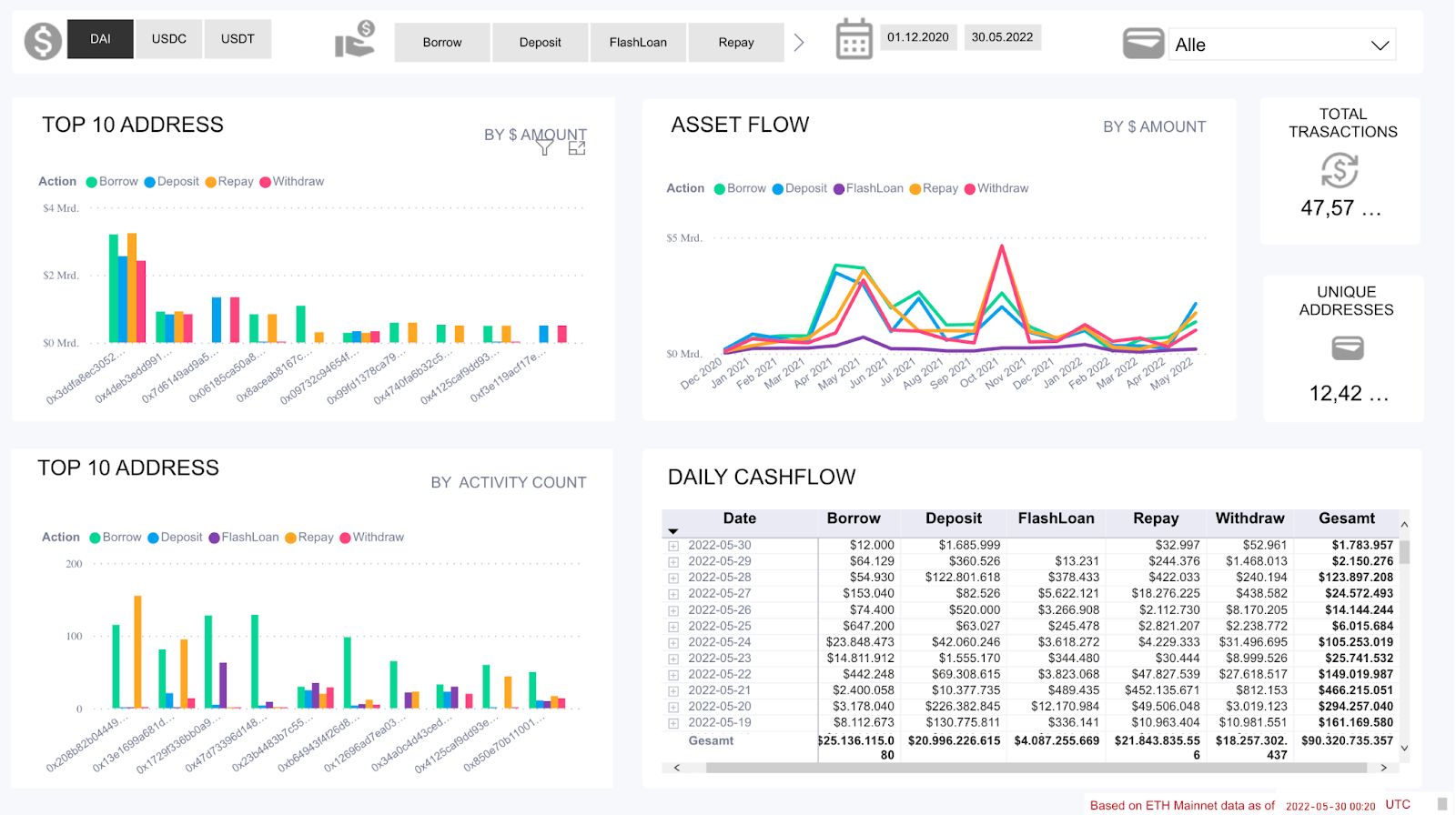

Lenders will feature metrics like VaR and LCR for Aave and Compound. The new PowerBI Dashboard will also show data on Aave and Compound such as the flow of assets, top 10 transaction count, top 10 wallets, etc

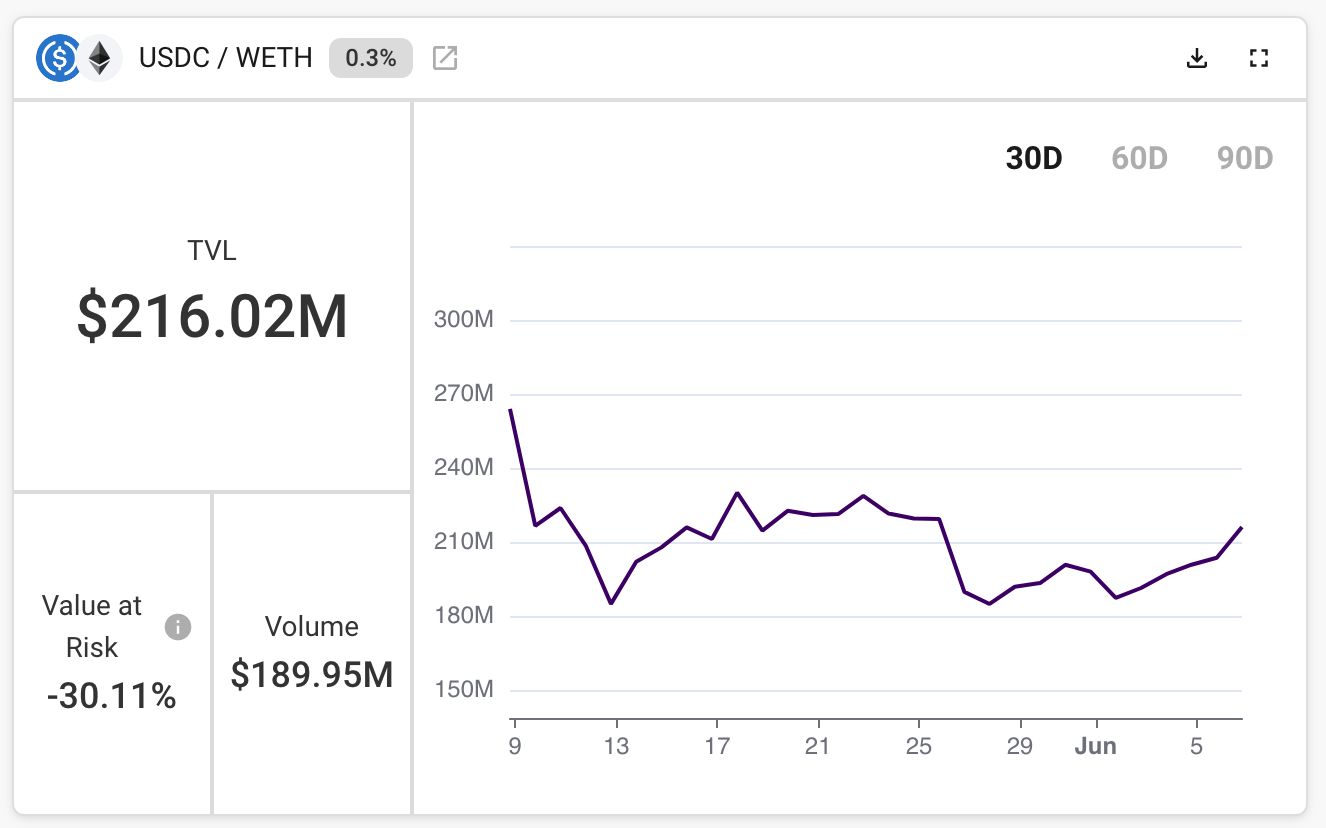

DEXs cover VaR, TVL, and Trading Volume metrics for the Top-10 pairs across Uniswap, Sushiswap, and Curve

Credmark Analytics will show all relevant stats on Credmark’s native token $CMK and display the models that are most popular in terms of queries via our API.

All of the data in the Terminal will be available on 30-day, 60-day, or 90-day timeframes and can be downloaded in CSV format.

Sharpe Ratio Use Case

Sharpe Ratio is an established metric to compare risks and returns of assets. As we adjusted it to be compatible with DeFi, users are now able to compare the Sharpe Ratio for up to 5 different tokens across a time series.

Lender Use Case

While the lender's section only covers Aave and Compound at the moment, the purpose of these charts is to showcase the liquidity and solvency of lending protocols over time. These metrics are useful indicators to assess when the protocols may be undercollateralized or how much value may be at risk in a black swan event.

Lending Pool Usage Use Case

The Lending Pool Usage is a great tool to see the top lenders or borrowers of DAI, USDC, and USDT stable coins on Aave and Compound. Users can quickly visualize:

- number of daily active users,

- daily cash flow activities, and

- the behavior of a wallet address.

Users can also perform more in-depth analysis by right-clicking on a dataset and pressing drill through. All information is neatly presented up to the exact transaction hash and block timestamp.

DEXs Use Case

Providing liquidity is a lucrative way to earn money, but it is risky. Our dashboard can provide insight into potential risks with the use of VaR or inform users of the imbalance within various Curve pools.

Take for example, the USDC / ETH pool on Uniswap V3 has a VaR of -30% which indicates the possibility of losing up to 30% of your total LP position in a worst-case scenario.

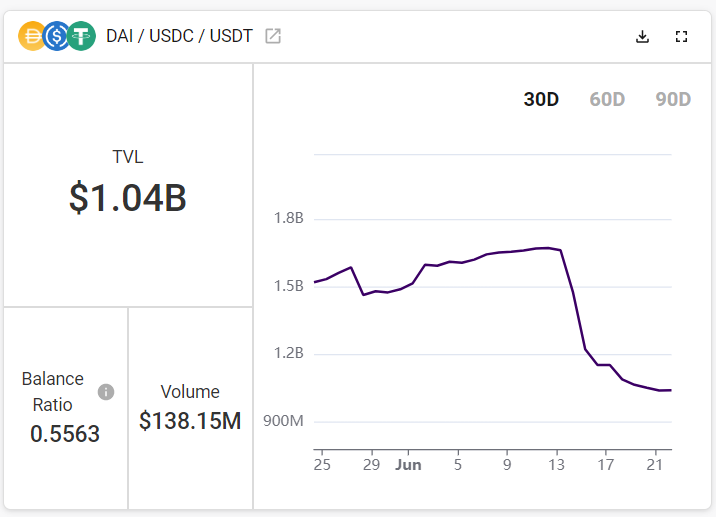

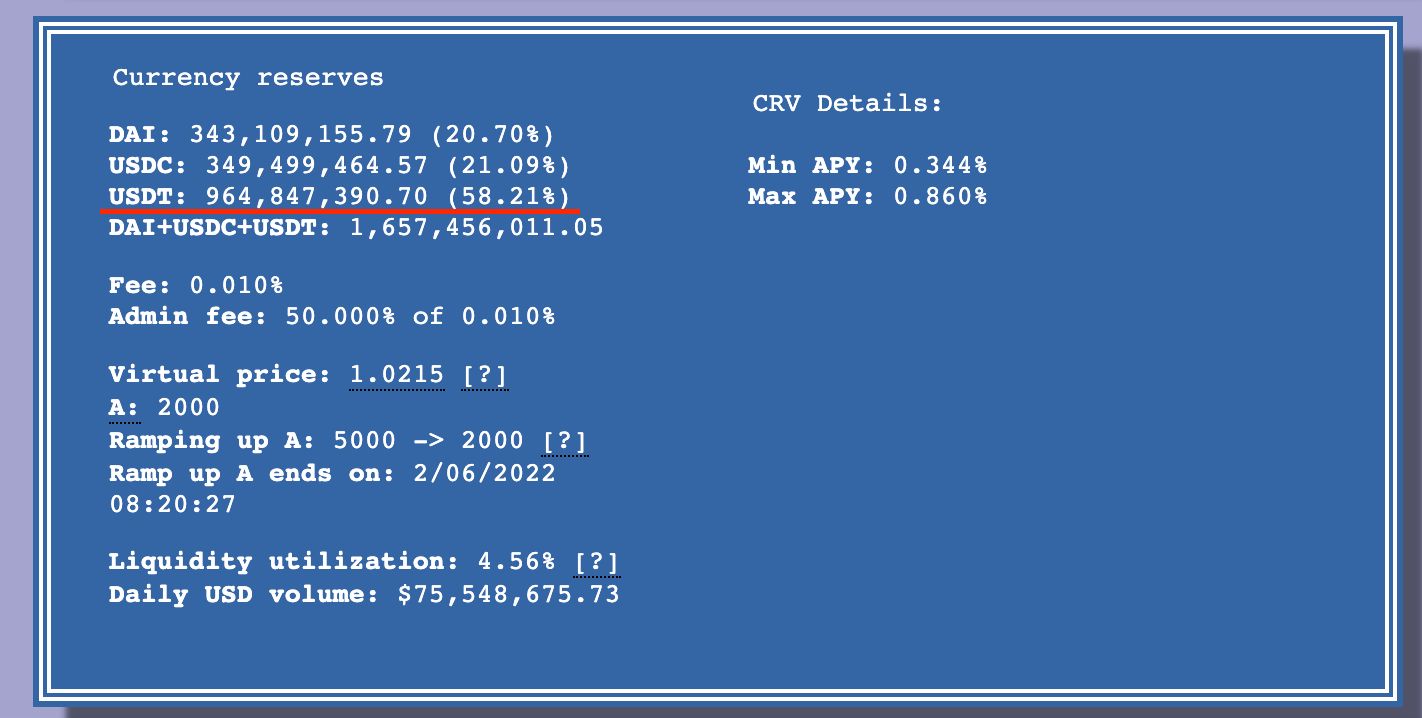

Now if we look at the Curve 3Pool, the balance ratio less than 1 which reflects an imbalance towards USDT in the pool:

What’s Next

The Credmark Terminal is an application that demonstrates how powerful Credmark’s data is. As more sophisticated models are built, the more utility the Terminal will have. A full list of the current models can be found in the Credmark Gateway. A lot of the current models are built with the same parameters as traditional finance. At Credmark, we’ve been at work to develop crypto and DeFi native models. This is just the beginning. We will release some useful interactive dashboards very soon. Join our community and let us know what you think or what you would like to see.

About Credmark

Credmark is a financial modeling platform for DeFi, powered by verifiable on-chain data. It provides the infrastructure necessary to build models. An API allows anyone to consume the output of these models.

Our modeling tools are the most flexible and robust available today. The Credmark Model Framework streamlines prototyping and deployment. Community members are incentivized to build and improve models. As a result, users benefit from verifiable data and best-in-class analyses.

Credmark is a decentralized project. Our community participates in governance, provides research, and develops models. Become a member of Credmark to advance the next-generation financial system.

Sign up for our newsletter for the latest product updates, partnerships, and more.