Product Roadmap to Scale: Increasing Utility of CMK

Collier Gray

2021/06/21

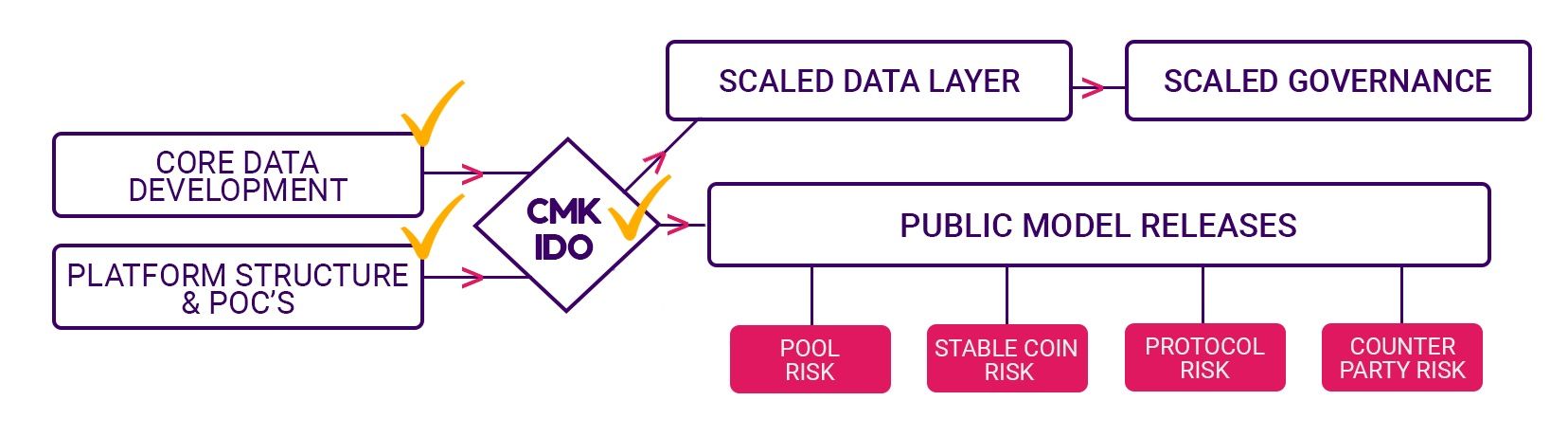

Credmark is a project that was established on the principles of providing utility to a token that can support a fully Decentralized Autonomous Organization. Since 2018 the Credmark team has been working to improve the data integrity and modeling ecosystem in the crypto space. We are releasing an overview of our roadmap to how we will scale into a completely decentralized organization based on token incentives for community members who engage with our platform.

Each incremental release of products and tools empowers retail DeFi and increases the utility of the token by expanding where and how CMK can be used. After releasing our core, scalable infrastructure, each incremental feature will require staking of tokens, and thus create positive price pressure. As our platform is built out and our community grows, token demand will increase with the number of model contributors and governance participants.

This blog post sets out to explain our product roadmap, and the correlated impact on supply and demand:

STEP 1: TOKEN DEVELOPMENT & IDO TO CREATE LIQUIDITY

The Credmark team felt strongly that a token should be introduced early on in the development of a DAO. Releasing a token is critical to filling essential data & risk management gaps in the DeFi ecosytem, while also creating an incentive structure for the core team to create true value for the platform. Because a portion of the total token allocation was set aside for the core team with years long vesting periods, we are incentivized to create a durable and dynamic community and tie CMK to the health and success of that community.

Perhaps most importantly, this high supply/low demand dynamic allows community members who have followed and supported our project to enter the market early, and affordably. These “quality” community members can later use their tokens to stake models or participate in governance, and earn rewards for doing so.

Tokenomics Impacts:

- Creation of high-supply environment.

- The 10 million CMK released represent most of the first year liquidity.

- Tokens have low utility because the core platform has not yet been released.

STEP 2: DATA LAYER & COMPLETE CORE PLATFORM INFRASTRUCTURE

Immediately following the token release, the Credmark team will focus all of our development resources on scaling a highly functional data layer. The team will extract and cache data from the ethereum virtual machine that will then be wrapped so it can be called by model APIs.

During this phase we will begin to work with partners to establish & test our staking mechanisms. Staking is the requirement for model developers (and later, governance holders) to lock up tokens in order to interact with our platform- effectively tying them up and lowering the overall circulation of CMK.

Tokenomics Impacts:

Limited impact on supply as CMK is removed from circulation to test our data layer.

- No additional liquidity will be introduced to the market during this time.

- Token utility is still being established.

STEP 3: MODEL DEVELOPMENT & DEVELOPER PORTAL

Once we have finished our data layer, the Credmark team will start releasing models to bootstrap the platform. We will stake tokens, locking them up and taking them out of the circulating supply, in order to put the models on our platform.

The Credmark team has already created models that allow for risk-adjusted trading in Decentralized Exchanges. Our Product demo, which mitigates risk with asset correlation, is one such example. Others are in development, including a stablecoin model. As we expand our models to systemic protocol risk, the number of model categories we will offer will continue to increase (along with the staked CMK required to put them on our platform).

Tokenomics Impacts:

- Increasing demand for CMK as the number of models the Credmark team and third party partners

- Low, if any liquidity introduced to the market as early investors start to vest small amounts of CMK.

- Intrinsic token utility.

STEP 4: TOKEN STAKING FOR COMMUNITY GOVERNANCE

While the Credmark platform is being bootstrapped by models with proven utility, we will be actively employing Governance structures. Governance go-live will follow quickly on the heels of initial model releases. Like model submission, Governance participation will involve the staking of tokens. The Credmark team will start Governance staking with key, pivotal decisionslike which protocols or chains to expand to, providing and moving price support, etc. but eventually will cover every aspect of product development and expansion.

As with models, expansion of community governance will create an increase in demand for tokens. By creating models and tools that benefit users of our platforms, we will generate interest in governance participation. Our goal is to let the market optimize our development prioritization so we deliver what the DeFi community needs to grow.

Tokenomics Impacts:

- Create a new mechanism for upwards price pressure and rewards as platform adoption & utility increases.

- Liquidity will start to creep back into the market as we reach cliffs for investors and community members are paid out CMK rewards for governance and model submission creating moderate downwards price pressure.

- Stabilize relative supply and demand, which will allow us to move towards decentralization.

The CMK token launch was designed to produce stability and encourage community entry into the market (which you can read about here). Our token is a rare bird in the crypto space, both because of the wonderful community we work with and the tokenomics that support them.

We are excited to see platform, utility, governance, and community growth!

Sign up for our newsletter for the latest product updates, partnerships, and more.