Decentralized Prices are Better than Centralized Prices

DeFi > CeFi

Wen-Chiao Su

2022/11/10

Resources to check-out:

A few weeks ago we published a piece called “It's Time to Decentralize Crypto Prices”. It points out the absurdity of the current situation:

DeFi relies on centralized price data.

- Centralized prices – i.e., prices provided by centralized exchanges – are opaque and unreliable.

- Decentralized prices – i.e., prices derived from on-chain data – are transparent and verifiable.

Several readers asked me to explain why lack of transparency is a problem. Here goes.

How Exchanges Work

Before going any further I’m going to quickly review how centralized and decentralized exchanges work. This is going to be very high-level since I’m essentially condensing a book into a few paragraphs. There are lots of variations on these themes, but those don’t matter in this context.

Order Book Exchanges

Centralized exchanges (CEXes) are based on order books. For every trading pair the exchange keeps track of what traders are willing to pay for a certain amount of another asset (bid) and what other traders are willing to accept (ask). When bids and asks match, a trade is made. Although exchange personnel have a big incentive to behave ethically (jail), they are human, and market makers’ incentives don’t always align with traders’.

Automated Market Maker Exchanges

Decentralized exchanges (DEXes) are based on automated market makers. These are smart contracts that perform two functions:

- They manage liquidity.

- They process trades.

Liquidity can be provided by anyone and is usually provided as a pair, i.e., some of each asset in the trading pool.

When a user wants to swap asset A for asset B, A is added to the pool and B is extracted. The ratio of A to B determines the price. When the ratio changes, the price changes as well.

Manipulating Prices

Most exchange manipulation has one goal: provide misleading information to the market. This information can be price, volume (a proxy for interest), or even volatility. Knowing that everyone believes something that isn’t true, or vice-versa, is an easy way to make money!

Bots

In a CEX environment bots can be used for all sorts of nefarious purposes, i.e., generating

- fake volume,

- fake prices, and

- fake momentum.

In DeFi, bots are primarily used for arbitrage, which is a net positive. These bots guarantee that prices between liquidity pools remain constant. Of course bots running against DEXes have been used to achieve the same ends as CEX bots, but it’s far more difficult due to the transparent nature of DeFi. After all, everything is recorded on a public blockchain.

Wash Trading

Wash trading is buying an asset from one counterparty and then immediately selling it to another. This generates fake volume. It’s illegal, but it happens all the time on centralized exchanges.

On DEXes it would be a waste of time since both transactions would be visible to the world.

Exploiting Patterns

Fake volumes, prices, and momentum are easy to exploit if you know they’re fake. As mentioned earlier, this misleading data could be intentionally created using bots, or even live traders. Sometimes the source could be harder to track down: unusual trading activity, rumors, or incorrect reporting can all lead traders to make the wrong assumptions.

Trading on DEXes doesn’t of course protect a trader from all of these, but, in general, transparency makes them less likely to succeed.

Danger in the Wild

Exchange Intervention

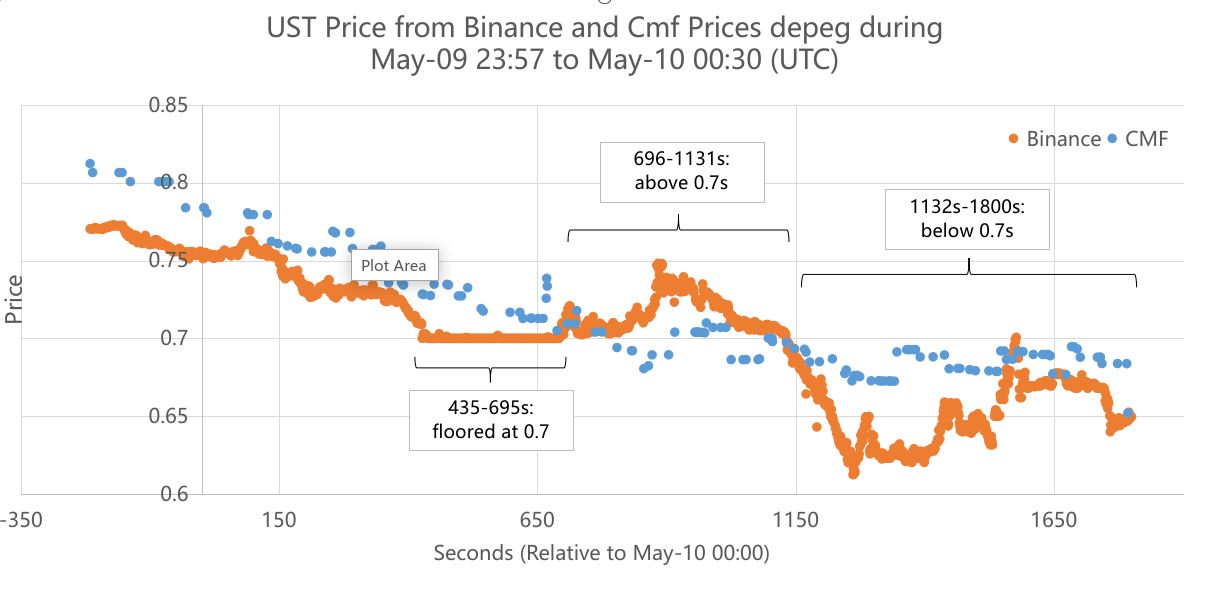

Sometimes unknown actors within exchanges can force the reporting of incorrect prices. We saw this clearly during UST’s collapse. While UST’s price fell steadily on DEXes, Binance artificially reported it at c. $0.70.

The chart below shows prices reported by Binance vs. prices Credmark derived from DEX data. It clearly shows the trading floor set by Binance while the token price was collapsing. Interestingly, the floor seems to have had its intended effect as the price rose after a few minutes on the Binance exchange while continuing to collapse on DEXes.

The artificial intervention to “instill confidence” ultimately failed. No matter the intention, the fake price was damaging to holders of UST who might have sold sooner had they realized that market confidence in the asset had evaporated.

Honest Mistake? Bug?

DeFi doesn’t rely on a single exchange feed like Binance, it relies on oracles which derive their prices from a large number of feeds, most of which are centralized.

As Cointelegraph reported after the LUNA collapse, oracles can also be misconfigured and, as a result, report incorrect prices. As the LUNA price was collapsing, Chainlink (a centralized organization managing decentralized data sources from mostly centralized exchanges 🤷🏻♂️) paused the LUNA price feed when it was reporting a price of $0.107. Unfortunately, traders continued to act on this price as the real price fell below $0.01.

Anyone relying on Chainlink prices was in the dark. Clever traders exploited this “mistake” and made millions of dollars. Naturally, other people lost millions of dollars.

So Which is Better?

It’s very clear that prices derived from public DEX data are more fair than prices reported by CEXes.

The shenanigans and mistakes that can affect prices on centralized exchanges are endless. I’ve only mentioned a few. In traditional finance, an entire regulatory infrastructure exists to discover price manipulation and punish the people engaging in them.

Ultimately, both accurate and inaccurate prices are published and become part of history.

We argued last week that prices derived from DEX data were both more transparent and more democratic. Transparency makes manipulation more difficult, a huge benefit. Democratic data is available to everyone, so anyone can act on it without fear that of being exploited by someone who knows more than they do.

About Credmark

Credmark runs a financial modeling platform powered by reliable on-chain data. We curate and manages DeFi data making it available via API and the Snowflake Marketplace around the globe and across industries.

Our community of quants, developers, and modelers actively build models for the DeFi community by leveraging our data API and tools. Join the growing community and together we will advance the next-generation financial system.

Sign up for our newsletter for the latest product updates, partnerships, and more.